Strategic Investments With Manufactured Home Communities

An investment platform focused on creating consistent value through strategic acquisition and management of mobile home communities.

The Process

Our Strategic Process

Learn how Pikewood Capital’s strategic approach drives effective acquisitions, optimized management, and long-term value across our portfolio of manufactured home communities.

We Acquire

We acquire communities with strong growth potential, building a stable asset base for long-term value.

Rent Collected

Rent collection provides cash flow with residents maintaining their homes, which helps reduce management costs.

Cash Distributed

Operations aim to generate consistent cash distributions, supporting a sustainable financial model for stakeholders.

Value Added

Strategic improvements enhance community appeal, operational efficiency, and increase the potential for long-term asset growth.

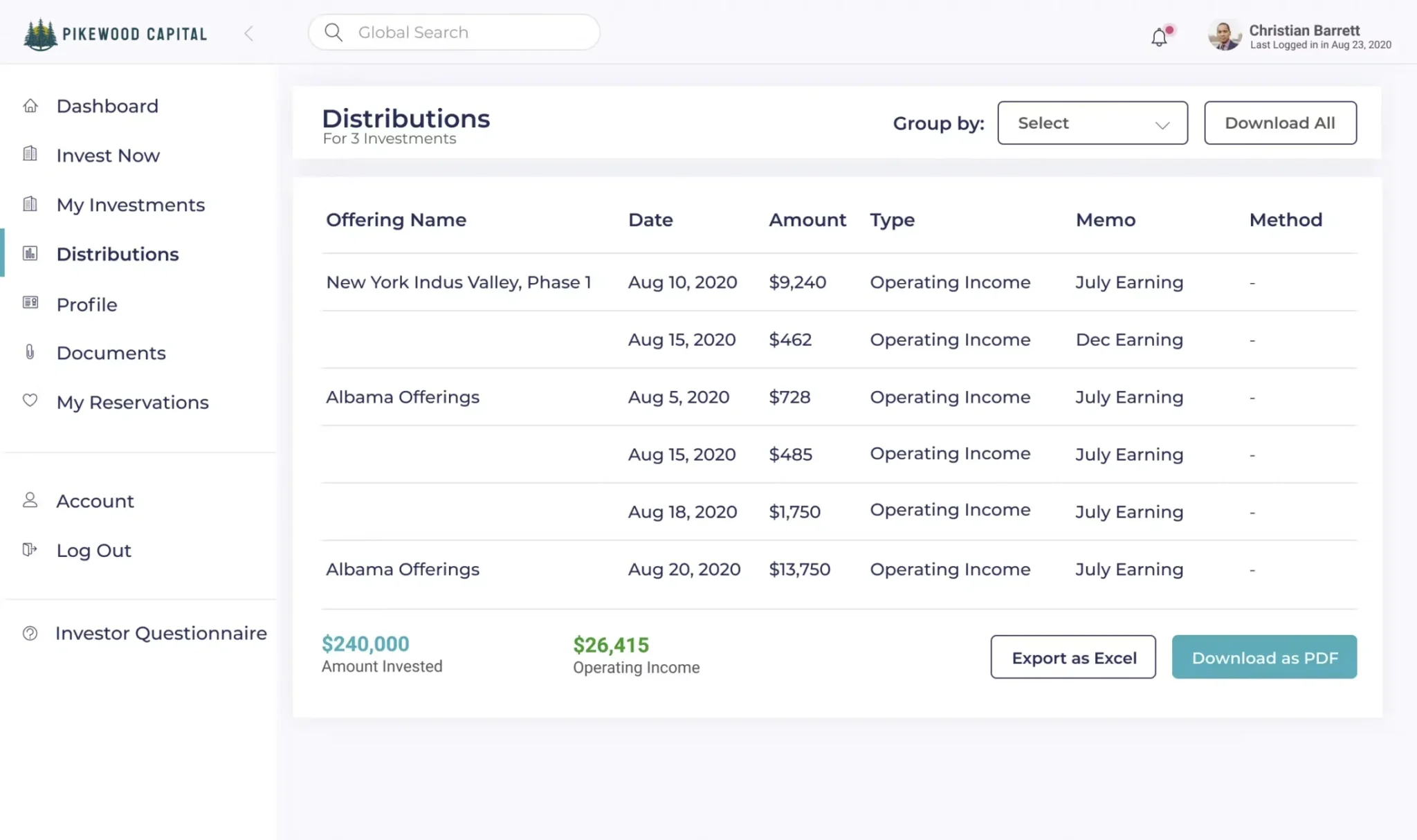

Get A Birds Eye View Of Your Investments.

Access comprehensive insights into your portfolio with an organized, high-level view of all your investments in one place with Pikewood Capital.

- Detailed metrics & reporting

- Transaction Details

- Access to new opportunities

- Communicate with partners directly

The Facts

Why Manufactured Home Communities Are Superior Opportunities

Manufactured home communities offer stable cash flow, low maintenance costs, high demand, and growth potential—making them a valuable long-term asset.

Consistent Cash Flow Potential

With lower turnover and vacancy rates, mobile home parks often provide reliable cash flow, benefiting from residents owning their homes.

Lower Operational Costs

Owners typically only manage infrastructure, as residents maintain their own homes, resulting in reduced maintenance and operational expenses.

High Demand for Affordable Housing

Mobile home parks meet growing affordable housing needs, leading to high occupancy rates and a stable tenant base.

Long-Term Appreciation & Value-Add Opportunities

Parks offer value-add opportunities through upgrades and benefit from land appreciation, enhancing long-term value and revenue potential.

Recession Resilient

Mobile home parks are often less affected by economic downturns due to steady demand for affordable housing options.

Tax Depreciation Benefits

Mobile home parks offer tax depreciation advantages, allowing owners to offset income and enhance cash flow.

What Our Partners & Investors Think About Us...

Fostering lasting relationships with our partners and investors through trust, transparency, and exceptional performance in every transaction.

Alex R.

"Working with Pikewood Capital has been a seamless experience. Their professionalism, transparency, and commitment to each deal make them an ideal partner in this space. We look forward to many more successful collaborations."

Michael T.

"Investing with Pikewood Capital has been a great experience. They deliver steady returns, keep us informed, and manage assets with precision. I’m confident in the value they bring."

Karen M.

"PikeWood Capital brings a refreshing level of expertise and integrity to every transaction. Their ability to close deals efficiently and fairly has made them a valued partner in our network."

Susan L.

"Pikewood Capital’s approach to managing mobile home communities is both professional and transparent. I’ve seen consistent performance and feel secure with my investment."